Denver Metro Area Real Estate Market Update

Denver Area Real Estate Market Update Our latest real estate stats are out from November, and we’re definitely seeing a “give and take” between buyers and sellers to close deals in the Denver Metro market. Homebuyers are gaining more negotiating power as demand has lagged across the area. At the same time not all sellers have been willing to bring down their list prices too aggressively. However, there have been many instances where both parties have come together to make a great deal for both sides. The recent improvement in mortgage interest rates has helped bring more buyers to the market. Will interest rates continue to lower? We will see how the economic and inflation news pans out this month. Here are a few additional notes: Detached active listings at month end dropped to 4,572, a 16.02 percent decrease from last month, while attached homes dropped 8.94 percent to 1,681, representing a 216.62 increase year-over-year for detached homes and a 109.08 increase year-over-year for attached homes. While inventory increased from last year, the market is still witnessing the typical end-of-the-year inventory decrease, which is likely a direct result of homeowners choosing to either wait to list their homes until the New Year or remove their properties ahead of the holiday season. Average days in the MLS increased 20 percent month-over-month to 36 days, which is exactly a 140 percent increase from this time last year. The attached market also exhibited a 20 percent increase month-over-month to 30 days, which is a 76.47 percent increase from this time last year. As the active listings count has grown, days in the MLS have also increased since May in direct relation to interest rates. Interest rates affect a buyer’s ability to afford a home, and as a result, buyers are taking more time to evaluate the value of each home, indicating that buyers are more discerning. The average price dropped 0.58 percent month-over-month from $736,675 to $732,437. While this is a small drop, this is also a 4.17 percent increase from this time last year when the average price was $703,119. Additionally, market-wide price reductions are slowing, and close-price-to-list-price percentages dropped only 0.40 percent for attached and detached properties. Do you need help navigating this real estate market? I’d be happy to meet over coffee to put together a plan to help you accomplish your real estate goals whether buying a home or selling or both! -Drew

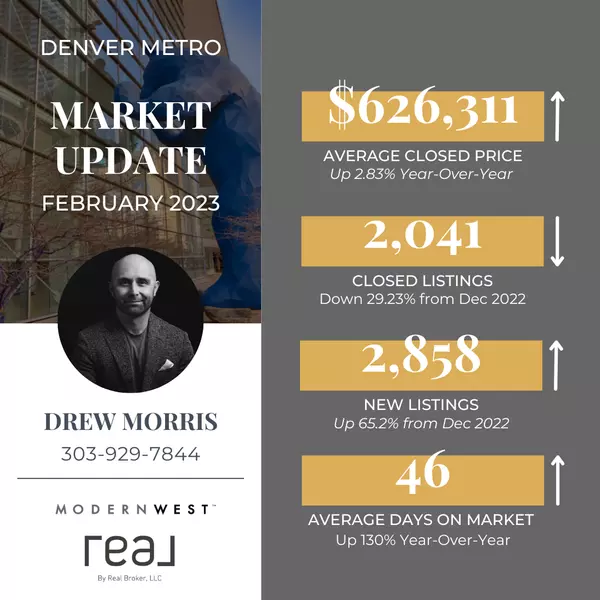

Denver Real Estate Update!

2023 is in full swing and the big question on everyone’s mind is what in the world is going to happen in the Denver area real estate market this spring. Will it be a usual spring market in Denver where almost every home on the market receives multiple offers? We’ll see how February plays out. But from what I’m seeing right now, homebuyer activity is starting to increase while the number of new listings to the market lags (although we had a nice jump in Jan!). I’ve already seen several listings on the market move within the first weekend with at least 2 or more offers. I’m also seeing homes that are overpriced sitting longer. So while buyers want to find that next home, they aren’t jumping at just anything unless it’s a great fit. What’s helping with the demand? The 30 year mortgage rate dropped to 6.19% as of last Friday (The VA home loan interest rate dropped to 5.65%) Interest rates will continue to have a significant impact in our market demand. Homebuyers will no doubt remain sensitive to any upticks or reductions in rates going into the spring. Will home prices drop? That remains to be seen. But remember that ultimately supply vs demand is what will dictate the direction of home prices. Curious about what’s affecting supply and demand locally? Let’s talk about the economy! Check out the event I’m co-hosting with a local Veteran’s entrepreneur hub, Bunker Labs. https://www.eventbrite.com/e/happy-hour-sip-learn-denver-metro-economic-update-and-rental-trends-tickets-528715581537 Reach out anytime and let’s dig into the market where you’re living now or where you’re interested in going! Drew Morris

How Experts Can Help Close the Gap in Today’s Homeownership Rate

As we celebrate Black History Month, we reflect on the past and present experiences of Black Americans. This includes the path toward investing in a home of their own. And while equitable access to housing has come a long way, homeownership can be a steeper climb for households of color. It’s an important experience to talk about, along with how it can make all the difference for diverse homebuyers to work with the right real estate experts.We know it’s more challenging for some to buy a home because there’s still a measurable gap between the overall average U.S. homeownership rate and that of non-white groups. Today, the lowest homeownership rate persists in the Black community (see graph below):Homeownership is an essential piece for building household wealth that can be passed down to future generations. However, there are obstacles in the homebuying process that can negatively impact certain groups. This can delay or prevent many from achieving homeownership, challenging their ability to benefit from everything owning a home offers. A recent report from the National Association of Realtors (NAR) explains:“. . . not all [households] have the same opportunities to homeownership, with many of them facing more constraints in their effort to achieve the American Dream. . . . Given that homeownership contributes to wealth accumulation and the homeownership rate is lower in minority groups, data shows that the net worth for these groups is also lower.”However, with the right support and resources, there are solutions if you’re part of this community and planning to buy a home. Jacob Channel, Senior Economist at LendingTree, shares:“The problem does exist. We have data that back that up. But there are solutions, and Black homebuyers shouldn’t lose faith that they’ll never be able to become homeowners.”That’s why it’s so important for members of diverse groups to have the right team of experts on their sides throughout the homebuying process. These professionals aren’t only experienced advisors who understand the local market and give the best advice. They’re also compassionate allies who will advocate for your best interests every step of the way.Bottom LineAccess to housing improves every day, but there are still equity challenges that some buyers face. Let’s connect to make sure you have an advocate on your side as you walk the path to homeownership.

Recent Posts