Denver Metro Real Estate Update

Here are a few key points to know about the Denver area’s real estate market right now:

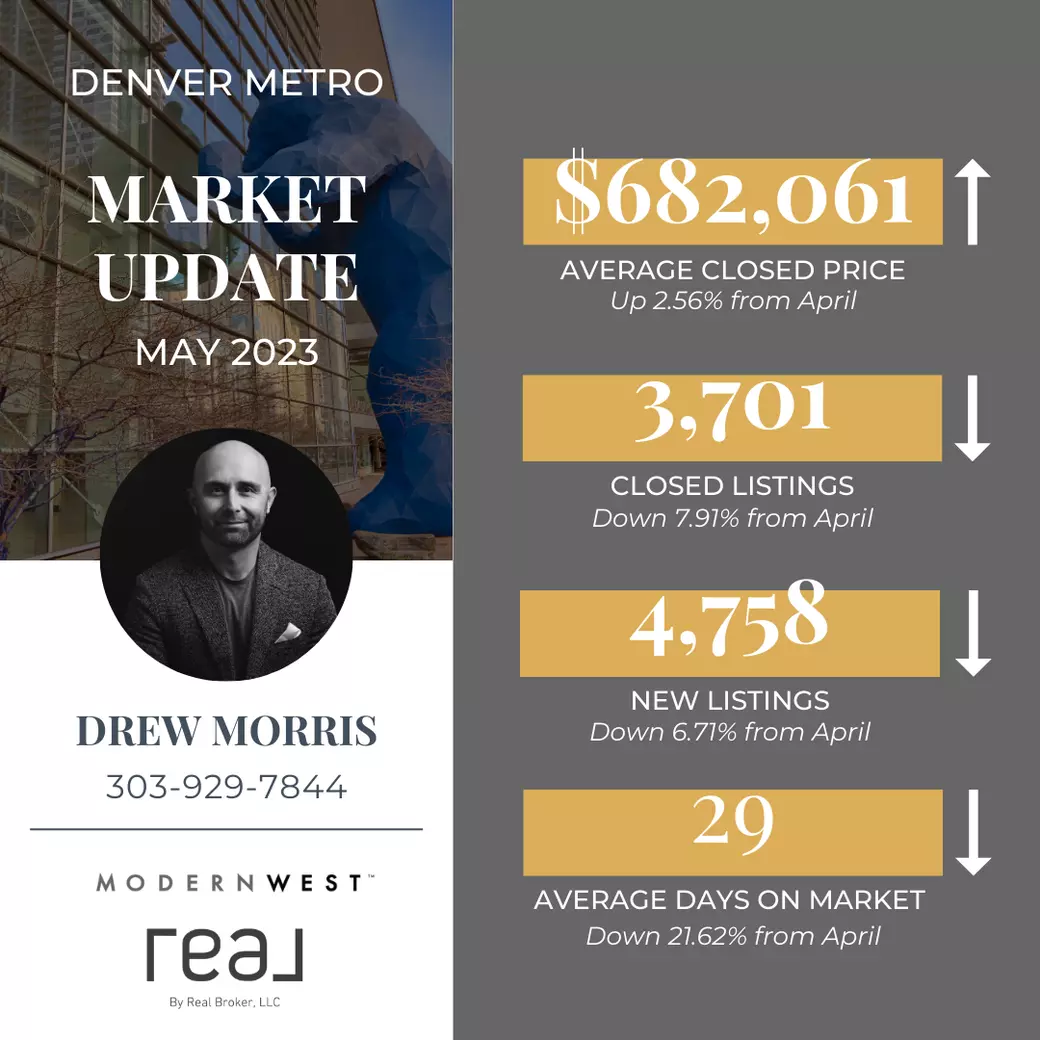

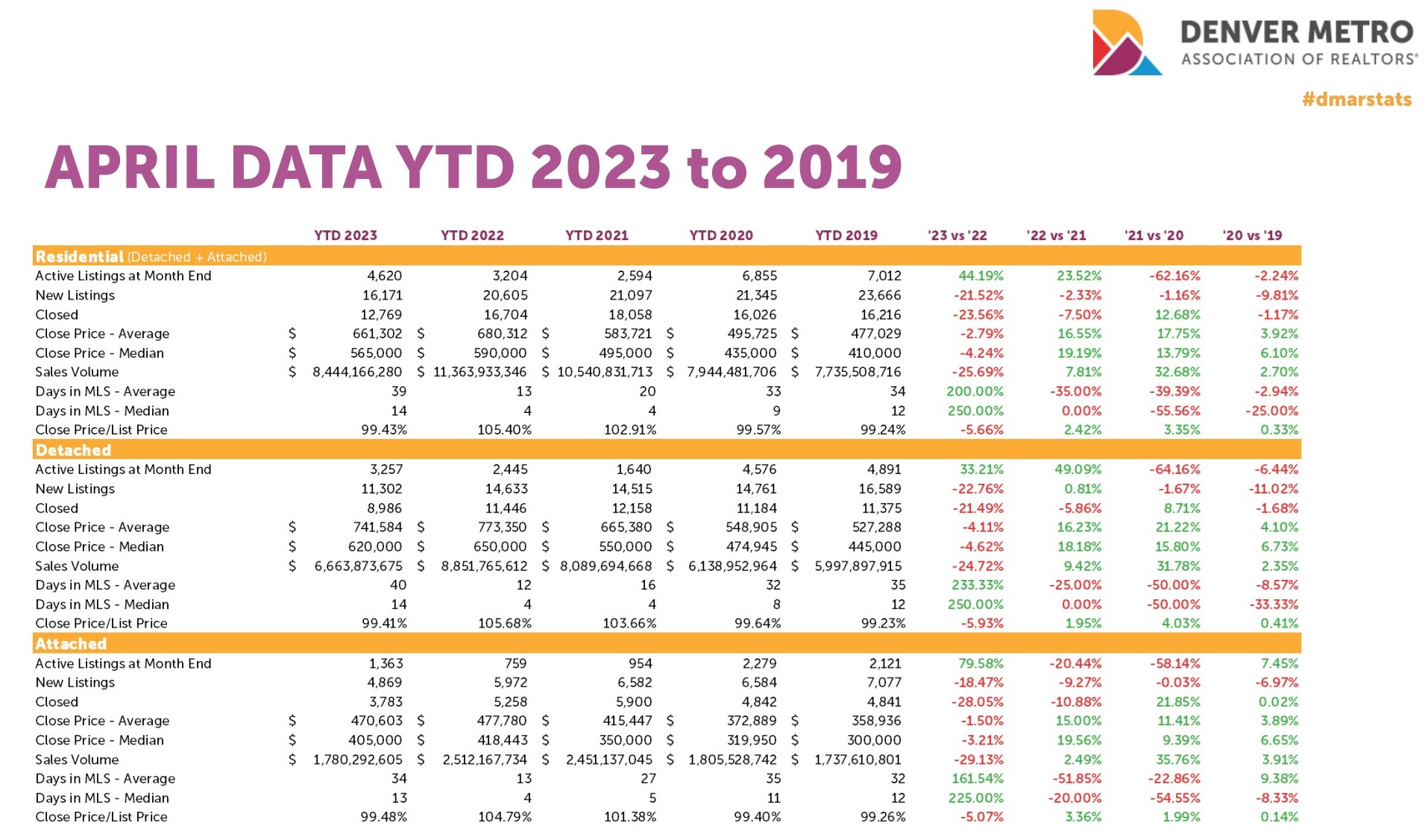

- The average price of homes grew slightly from last month, but is still lower than this time last year.

- We have an inventory problem. The number of new listings to hit the market is lagging so much that we are about 4,400 homes behind where we were this same period last year. Compared to 2019, we are about 7,400 homes behind!

- A lack of inventory has also created a massive drop in the number of real estate transactions happening (closings). With only 12,769 closings so far in 2023, we’re about 3,900 behind 2022 and 5,200 behind 2021 for the same time period YTD.

- Where are we seeing improvements in the market? The “Days in MLS” was 29 in April, which was 8 days faster than March.

So what might we expect in the immediate future for our real estate market? Let’s look at two metrics: mortgage apps and showing activity. Both of these could be considered leading indicators to home purchase activity.

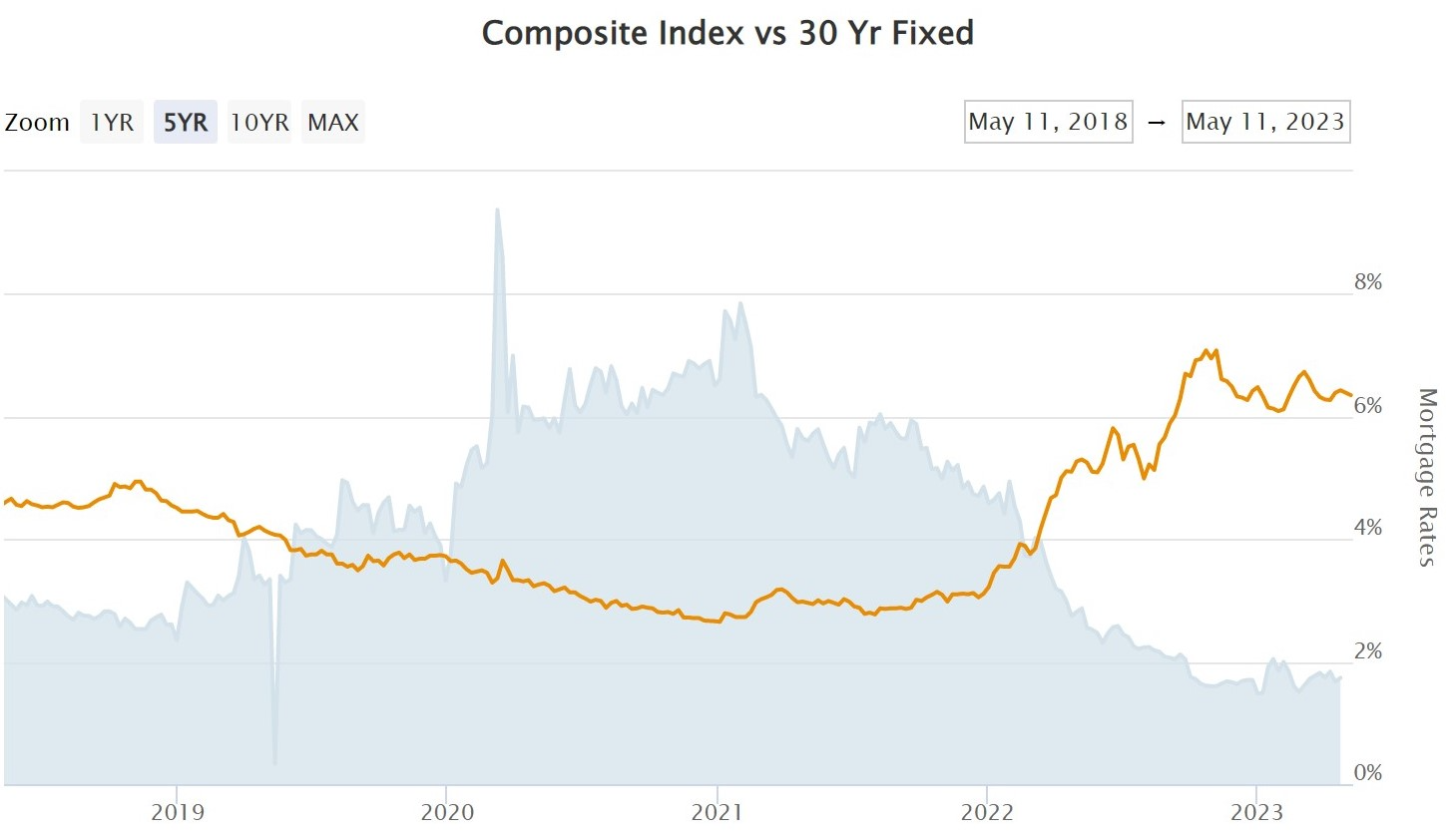

Purchase mortgage apps nationally are incredibly low - some of the lowest numbers ever seen. That means there are less buyers applying for mortgages to buy a home - which could mean that there are less buyers in the market to buy.

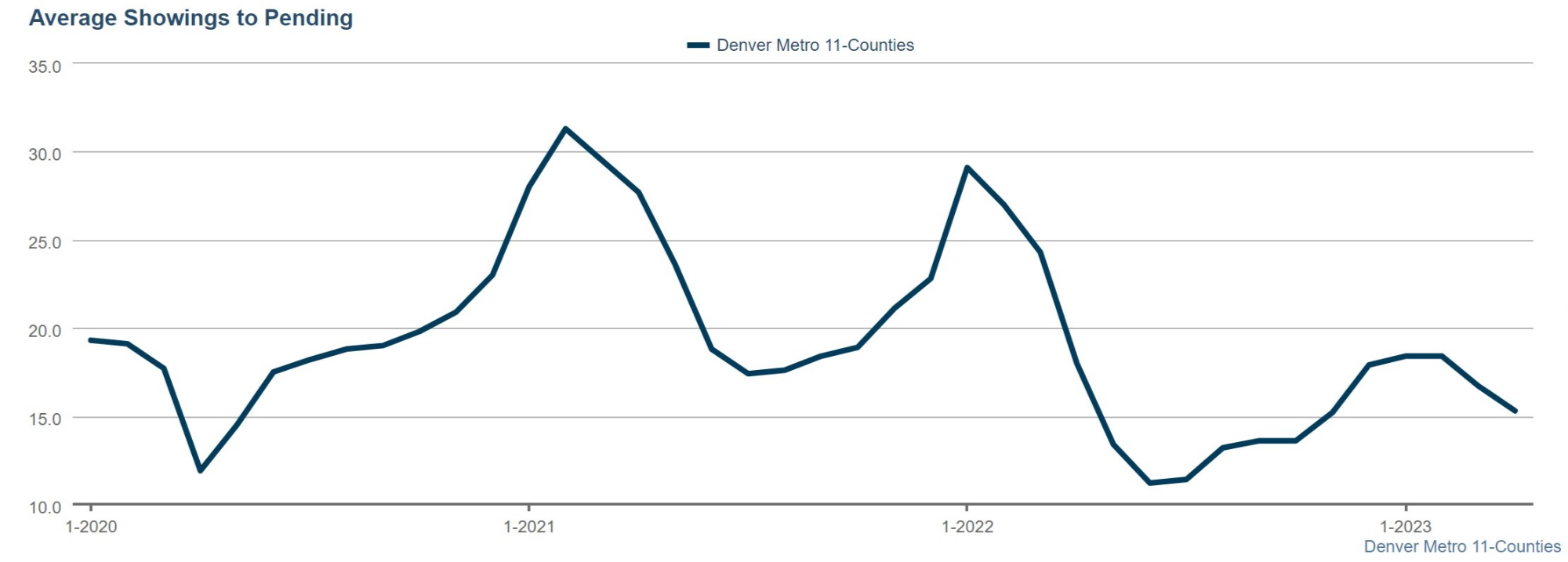

While that may be the case, being in the market daily here in the Denver metro area, I can tell you that there are still plenty of buyers out searching for a home. Take a look at these showing numbers per listing that went pending.

So it’s clear that for those homes that went under contract, we are seeing steady showing numbers indicating that there is still demand for homes locally. With inflation cooling off, we should see interest rates taper off as well. That’ll most likely create a boost to demand in an already low inventory environment.

It’s an interesting mix of results happening in the market. As a whole, I’d say the real estate industry is in a “recessionary” environment - during recessions we see massive drops in closed transactions which in our current case is brought on by worse affordability and less inventory (less to buy, so less closings). So our “output” as an industry is much lower. But for sellers, it’s actually still looking like a good thing. Because demand is still outpacing inventory, prices should be steady or grow and you will have a buyer for your home.

Each sub-market/neighborhood will have different activity and results of course. That’s where I come in. Want to dig into the data in your neighborhood? Let’s set up a time to chat. Reach out via text, phone, or email anytime. Looking forward to hearing from you!

Recent Posts

We're here to serve in a way that creates the best real estate experience for you from the mountains of Colorado to the Florida Gulf Coast.